Medicare

What you need to know to get started

If you are near the age of 64, a Medicare application is required to avoid financial penalties. Seniors must apply for Medicare between 64 years and 9 months of age and 65 years and three months. The application is easy and can be completed online, but the decisions that need to be made to complete the application are not so easy. That’s where SMD insurance can come in. We’re here to inform you of all the different plans and help you find the plan that best fits your situation. AT NO COST TO YOU.

Got questions?

Though the application is fairly straightforward, there are a few questions that are regularly raised about Medicare. Here are a few:

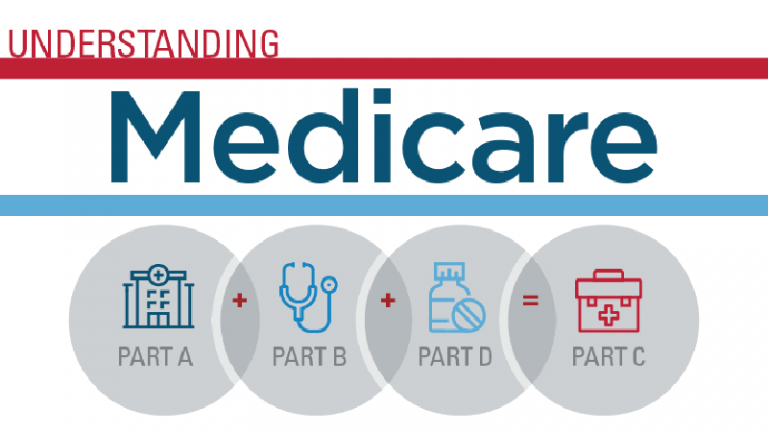

- What are Parts A, B, C, D?

- What is Original Medicare? What is Medicare Advantage?

- Which is better for me?

- I’m not retired so must I get Medicare?

- What is Medi-gap? Do I need it?

- How much does all of this cost?

What is Medicare Part A and what does it cover?

Medicare Part A is one of two parts that make up Original Medicare, the traditional Medicare service the federal government offers. The two parts of Original Medicare are Medicare Part A (hospital insurance) and Medicare Part B (medical insurance).

Medicare Part A helps cover a range of hospital care and services for patients in an acute hospital setting, a skilled nursing facility, and sometimes a home setting.

Inpatient Hospital Care:

It covers your stay in a hospital that accepts Medicare in Part A. It also covers any diagnostic procedures or medical care you require after being taken to the hospital.

To treat an injury or disease, a doctor must certify that hospitalization is required, and the facility must recognize Medicare.

Semi-private rooms, general nursing, drug treatment, food, hospital services, and supplies are all included in hospital services or providers. Your doctor might recommend services that Medicare doesn’t cover; in this situation, you will have to pay additional charges for Medicare. Furthermore, every private-duty nurse or private room will incur additional fees unless medically essential.

Hospital Stay(Longer than 60 days):

You will get this kind of coverage if a doctor formally admits you to a hospital for drug plan health. Besides the 60 lifetime reserve days, you are covered for up to 90 days throughout each benefit term in a general hospital. In addition, Medicare also covers 190 lifetime days in a psychiatric hospital.

If you are admitted within 60 days of an inpatient hospital admission in the past or if someone transfer immediately from an acute care hospital, there will be no additional deductible for an extended stay. Otherwise, a new benefit period starts if you have beyond the 60-day mark. You will have to fulfill the Part A deductible again at the start of each new benefit period.

Skilled Nursing Facility Care:

Expert Nursing Facility, providers of Medicare or drug plans is medical attention provided to diagnose and cure your disease by a trained nurse or therapist. If you have a hospital stay or your doctor has determined you need skilled care daily, the facility is Medicare-certified, and there are still days left in your benefit period. Part A coverage covers this on a short-term basis for drug plans.

Medicare pays for lodging, food, and find other open services offered at an SNF, such as the administration of medication, tube feedings, and wound dressings. If you are eligible for coverage, you are covered for up to 100 days throughout each benefit period. To be eligible, you must find skilled nursing or therapy treatments and have spent at least three successive days in the hospital within 30 days of your SNF admission.

Hospice in Medicare:

When you decide to get hospice care rather than therapy for a terminal illness, Medicare and other providers will pay for most of your medical expenses. Part A Includes treatment to relieve your symptoms and reduce your discomfort if you are chronically sick. Furthermore, it covers official home medical devices and residential care. You are covered if your provider verifies you require treatment and care.

Home Health Care in Part A:

Part-time or occasional skilled nursing care, physiotherapy, speech-language pathology treatments, or ongoing occupational therapy services are covered by Medicare if they are medically required. Medical social care, part-time or occasional home-based healthcare services, durable healthcare equipment, and hospital-quality medical supplies are all examples of additional home healthcare. Before certifying that you require home health care services, a doctor or other health care professional must examine you. A physician or other healthcare must prescribe your care professional. Furthermore, it must be delivered by a home health company certified by Medicare.

What is Medicare Part B?

Medicare Part B covers a wide range of medical services not covered during inpatient treatment. It is part of what is referred to as Original Medicare, the traditional service offered by the federal government, and consists of Medicare Part A (hospital insurance) and Medicare Part B (medical insurance). In this way, Part B picks up coverage where Part A’s hospital care ends.

Part B is optional, but if you rely on Medicare for primary coverage, it is strongly recommended to ensure complete coverage of your healthcare needs. Even if you have private insurance and do not rely on Medicare, you can use Part B in coordination with your coverage to reduce spending.

Inpatient care, outpatient care, home health care, durable medical equipment, and some preventative services are all covered by Medicare Part B (medical insurance).

Who is Eligible for Medicare Part B?

If you are eligible for Medicare Part A, you are eligible for Part B coverage, which is optional and carries a monthly premium for enrollees. If you are already enrolled in Social Security benefits, Medicare will deduct the Part B premium from your Social Security check. If this does not apply to you, then Medicare will bill you quarterly.

Additionally, if you don’t enroll during the initial period, you will face a Part B penalty. The Part B monthly premium will continue to increase until your eventual enrollment, should you choose to later. The premium increases 10 percent for every year that you don’t enroll while eligible.

Special Enrollment Period

Based on your current employment or that of your spouse, a group health plan may provide medical insurance coverage for you.

In this situation, applying for Medicare Part B at age 65 may not be necessary.

You might be eligible for a “SEP” that enables you to enroll in Part B during:

- Any month you or your spouse continue to work and are still covered by the group health plan.

- The eight-month span starts the month following the termination of your group health plan coverage or the earnings it is based on.

People who were performing volunteer work (govt authorized social or otherwise) outside of the country for at least a year on behalf of a tax-exempt organization and had health insurance that covered them throughout the voluntary service might join during this SEP if they did not initially enroll in Part B or premium Part A.

Part B Late Enrollment Penalty

For as long as they have Medicare, a person who did not enroll in Part B when initially eligible may have to pay a late enrollment fee.

Every 12-month period during which the individual could have enrolled in Part B but chose not to do so could result in a 10% increase in the monthly premium for Part B.

Coverage and Benefits

Part B covers many of the more expensive services that can occur during your hospital stay. This includes procedures like surgery, radiation, chemotherapy, dialysis, and diagnostic imaging, among others. Part B includes many preventive medical services such as doctor visits, ambulance rides, screenings, and diagnostic tests. It also covers preventative care like colonoscopies, mammograms, flu shots, and in some cases chiropractic care. Special Medicare drug plan is drafted in highly exclusive circumstances.

Medically Necessary Services

These are the services and supplies used to diagnose and treat medical conditions within standard medical practice. Also included are medical equipment, such as wheelchairs, hospital beds, and oxygen equipment.

Preventive Services

This refers to health care that either prevents illness or detects it at the earliest stage possible for optimal medical attention. In most cases, the patient will not have to pay anything for preventive services if your healthcare provider agrees to accept the payment amount Medicare approves for the service.

Diagnostic tests included are MRIs, CT scans, EKGs, and X-rays. Covered screenings often include pap tests, HIV screening, glaucoma tests, hearing tests, diabetes screening, and colorectal cancer screenings.

A licensed agent can help you determine if Part B fits your current needs. Connect directly with one of our agents to learn more with no obligation.